Small modular reactors (SMRs) potentially offer significant opportunities to manufacturers. If the UK can take an international lead in technology development, the UK supply chain could produce SMRs for the global market.

Small modular reactors (SMRs) are advanced reactors that can be largely built in factories as modules to minimise costly on-site construction. The International Atomic Energy Agency defines SMRs as producing up to 300MW of electric power, but the term is applied to some larger designs – though all are smaller than the current generation of gigawatt-scale reactors.

SMRs are generally based on Generation III+ pressurised water reactor (PWR) technologies which are relatively close to commercial readiness. The term advanced modular reactor (AMR) usually refers to a variety of Generation IV reactor technologies which are at an earlier stage of development.

SMRs should be much more affordable to build than current gigawatt-scale reactors, by avoiding the huge upfront costs and decade-long development times of current new build projects. An initial SMR power station would be a fraction of the cost of a gigawatt-scale new build, could be built in four or five years and, once operational, will generate revenue to help finance additional units. Rolls-Royce SMR is targeting a delivery price of £40–60/MWh for its power station.

Because SMRs are designed to be largely made in factories, manufacturers will be able to use lessons learned from other sectors such as aerospace to drive down costs, and exploit advanced manufacturing techniques which aren’t approved for current reactor designs.

With the UK’s net-zero commitments likely to require a quadrupling of low-carbon electricity generation by 2050, SMRs have a vital role to play in the energy mix. They are intended to complement the current generation of gigawatt-scale reactors, rather than be a substitute.

This page was last updated in September 2024.

UK SMR competition

In March 2023, the UK government announced a new competition to select the best SMR technologies for development in the UK. The process is managed by Great British Nuclear, with a shortlist of six SMR developers released in October:

- GE-Hitachi Nuclear Energy International – the BWRX-300 is a 300MWe water-cooled, natural circulation SMR. In January 2024, GE Hitachi secured £33.6 million from the UK government’s Future Nuclear Enabling Fund (FNEF) to start the GDA process. The Nuclear AMRC hosted a supply chain engagement event in March 2024.

- Holtec Britain – the SMR-300 is a 300MWe pressurised water reactor, developed in collaboration with Mitsubishi Electric and Hyundai Engineering and Construction. US-based Holtec proposes to deploy around 5GWe of SMRs in serial production in the UK by 2050. In December 2023, it secured £30 million from FNEF to start the GDA process, and completed the first stage in August 2024. The Nuclear AMRC hosted a supply chain engagement event in March 2024.

- NuScale Power – the Voygr SMR plant is based on NuScale’s Power Module, a 77MWe PWR and generator, designed to be deployed in clusters of up to 12 per site. The Nuclear AMRC worked with US-based NuScale on potential UK development at an early stage of development.

- Rolls Royce SMR – producing 470MWe from a Gen III+ PWR, completing the second phase of GDA in July 2024. See below for more information on how the Nuclear AMRC supported development.

- Westinghouse Electric Company UK – the AP300 is a 300MW PWR based on the established AP1000 technology. Westinghouse was approved to begin GDA in August 2024. The Nuclear AMRC hosted a supply chain engagement event in February 2024.

- EDF – the Nuward SMR is a 340MWe SMR plant with two Gen III+ PWRs of 170MWe each. EDF withdrew from the competition in July 2024.

In September 2024, GBN confirmed that GE Hitachi, Holtec, Rolls-Royce SMR and Westinghouse will progress to the next stage, with bidders invited to enter negotiations. Government will co-fund the selected technologies through their development, and work with successful bidders on financing and site arrangements, with a target of at least one final investment decision by 2029.

Other SMR developers

More than 70 designs of small modular reactor are in development in 18 countries, according to the IAEA.

A number of other SMR developers have stated their interest in UK deployment, including:

- X-energy is developing a high-temperature gas reactor for industrial decarbonisation as well as electricity generation. X-energy says its first units will be deployed in the US from 2027, with the UK to follow. X-energy UK is working with Cavendish Nuclear and partners including the Nuclear AMRC, with FNEF funding awarded in April 2024.

- newcleo is developing a lead-cooled fast reactor. The UK-Italian company is aiming to commercialise a 30MWe micro-reactor by 2030, followed by a 200MWe reactor fuelled by waste from existing nuclear plant. The Nuclear AMRC signed an MOU with newcleo in October 2023.

- UK Atomics, a subsidiary of Danish business Copenhagen Atomics, is developing a containerised thorium molten salt reactor, and aiming for deployment in 2028.

- MoltexFlex is developing a thermal neutron moderated version of Moltex Energy’s stable salt reactor technology, designed for cogeneration and industrial applications. Each Flex module will produce 16MWe or 40MWt. The Nuclear AMRC is working with Moltex on manufacturability and supply chain studies.

- Ultra Safe Nuclear is developing a micro modular reactor using the established Triso encapsulated fuel technology. Each cell will generate 5–10MWe (15–30MWt) per unit for industrial applications and off-grid power. The Nuclear AMRC has worked with Ultra Safe Nuclear on projects covering manufacturability, modularisation and supply chain.

- Last Energy is developing a 20MWe (60MWt) PWR for industrial and grid-balancing applications. The PWR-20 is designed for rapid scalable deployment with up to 10 reactors per site.

For the latest information on UK development of SMRs, see the DESNZ/BEIS page on advanced nuclear technologies.

Rolls-Royce SMR and the Nuclear AMRC

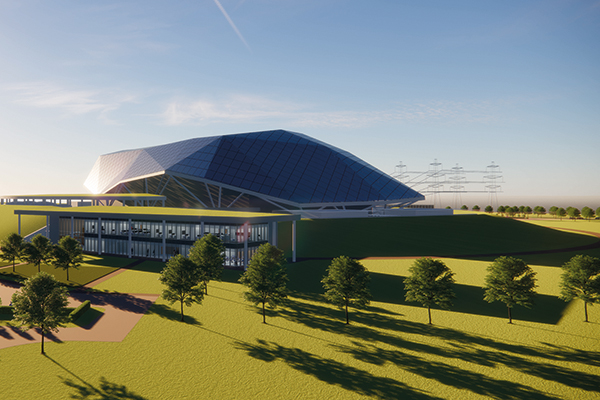

The Rolls-Royce SMR is a compact power station design, producing 470MWe from a Gen III+ PWR. Around 80 per cent of a Rolls-Royce SMR power plant could be delivered by the UK supply chain – to register your interest in supplying the programme, visit the Rolls-Royce SMR supplier portal.

Development is led by a dedicated business, Rolls-Royce SMR Ltd, with private investment supported by up to £210 million government match-funding from the Industrial Strategy Challenge Fund.

Rolls-Royce SMR aims to have its first power station in operation around 2030, with its reactor entering the UK generic design assessment (GDA) in April 2022. It completed the second phase in July 2024.

Initial development was carried out by the UK SMR Consortium, a collaboration of Assystem, Atkins, BAM Nuttall, Jacobs, Laing O’Rourke, NNL, the Nuclear AMRC, Rolls-Royce and TWI. The 18-month first phase was backed by an initial £18 million match-funding investment from the government’s Industrial Strategy Challenge Fund, and ended in early 2021. The Nuclear AMRC demonstrated how a range of advanced manufacturing techniques can reduce capital costs and production time.

In the second phase launched in November 2021, the Nuclear AMRC carried out manufacturing capability delivery projects in areas including fixed and portable machining, post-process cleanliness, measurement process development, welding, cladding, and digital manufacturing.

Key manufacturing technologies

Driving down production costs is the key to making SMRs economically viable. SMRs offer the nuclear industry the opportunity to become more like other high-value low-volume manufacturing sectors such as aerospace or oil and gas, where the UK has proven expertise. To achieve this, the SMR design must allow economies of volume when making 50 or 100 units, and manufacturers will need to demonstrate high learning rates as production ramps up.

UK manufacturers in other high-value sectors already use a range of processes which have not yet been approved by the UK nuclear regulator. By working with manufacturers, technology providers and researchers, SMR developers will be able to include new processes into the safety case for their new designs, and use techniques such as design for manufacturing and modularisation to build in production efficiencies.

Manufacturing processes which could be exploited for SMRs include a range of machining techniques such as robotic machining, single-platform machining and cryogenic cooling, as well as supporting technologies such as intelligent fixturing and on-machine inspection. Advanced joining and near-net shape manufacturing processes such as electron beam welding, diode laser cladding, automated arc welding, bulk additive manufacturing and hot isostatic pressing also offer significant savings in cost and lead time.

Many of these technologies are already being developed for civil nuclear applications by the Nuclear AMRC. The centre’s advanced machine tools and fabrication cells have been specified to work on representative-size parts for gigawatt-scale reactors, which means that they could also produce full-size prototypes for SMRs.

Since 2017, the Nuclear AMRC has worked with US-based EPRI to develop new manufacturing and fabrication methods for SMR pressure vessels. The project aims to reduce the total time needed to produce a vessel, based on NuScale’s Power Module design, from three to four years to less than 12 months. The project is funded by the US Department of Energy, and involves industrial partners on both sides of the Atlantic including Sheffield Forgemasters. Find out more about our work with EPRI on electron beam welding.